retroactive capital gains tax increase

They can terminate the S election retroactive to the first day of the tax year Sec. 2020-2021 Capital gains tax brackets Not all income is taxed according to the marginal tax brackets and capital gains income from when you sell an investment or asset for a profit are the big.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Relating to Capital Investments Act 215 2004-16.

. Net income after tax of 298 million and an operating income after tax of 951 million in the twelve months ended December 31 2021 compared to a net loss after tax of 564 million and an. For example the United States tax code places a double-tax on corporate income with one layer of tax at the corporate level through the corporate income tax and a second layer of tax at the individual level through the dividend and capital gains taxes paid by shareholders. Adoption of Certain Retroactive Provisions of the Internal Revenue Code and Amendments to Estimated Tax.

In addition the remaining shareholders can change the corporations accounting method resulting for example in passthrough income rather than an expected. Was extended through 2010 as a result of the Tax Increase Prevention and Reconciliation Act signed into law by President Bush on 17 May 2006 which also reduced the 5 rate to 0. Heres how they do it Advisors look to lessen toll of Bidens retroactive capital gains tax hike How Bidens tax plan may spark more.

Obligations Enter the amount of interest or dividends exempt from federal income tax but taxable in Virginia less related expenses. Capital gains income escape income taxation forever. 208 surcharge are combined.

Interest on federally exempt US. Accordingly it is advisable to pay out the balance of. Inasmuch as the need for working capital has long been recognized as the main reason.

Whereas Republicans may fight a broad-based tax increase. However capital losses realized subsequent to a distribution of the CDA will not have a retroactive effect on having previously received this distribution tax-free even if the loss is carried back. Both pieces of legislation could have significant impacts for middle.

Accumulation distribution income Enter the taxable income used to compute the partial tax on an accumulated distribution as reported on federal Form 4970. A capital gains tax CGT. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

41013 Certain Technical Issues 410131 Section Overview 410132 Accumulated Earnings Tax IRC 53 Skip to main content An official website of the United States Government. We welcome your comments about this publication and suggestions for future editions. The amount of the increase will be treated as a distribution by the selling.

The first change adopted as part of SB 1827 which is effective retroactive to January 1 2021 is the creation of a cap to prevent the combined top marginal tax rate from exceeding 45 percent when the general rates and the Prop. State tax statutes forms and instructions. Congress is debating two sets of new legislation that would impact the tax on farmer estates and inherited gains indicative of the momentum for changes to the current code for estate gifts and generation skipping taxes.

Krista Swanson Gary Schnitkey Carl Zulauf and Nick Paulson Krista Swanson The US. Capital gains can be offset with capital losses while dividends cannot be offset. Similarly several loopholes used by high-income.

And the new tax will not be retroactive. NW IR-6526 Washington DC 20224. The corporate tax rate on long-term capital gains currently is the same as the tax rates applicable to a corporations ordinary income.

Increase in the Little Cigar Tax on July 1 2011 and Correction to Department of Tax Announcement 2011-07. For extremely wealthy taxpayers a minimum income tax would require prepayment of taxes on unrealized capital gains such that liquid taxpayers are taxed at a rate of at least 20 percent on their income including unrealized capital gains. The QEF regime or taxed annually on the increase in value if any of the PFIC stock ie the mark-to-market regime.

On April 7 2022 Budget Day the Minister of Finance introduced Canadas 2022 Federal Budget Budget 2022. The provision also makes a retroactive technical correction to the Act toallow. Business Tax License Numbers to be Replaced.

While taxpayers may be relieved that Budget 2022 does not include an increase to the capital gains inclusion rate or restrictions on the principal residence exemption Budget 2022 does include a number of significant changes applicable to financial.

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

![]()

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

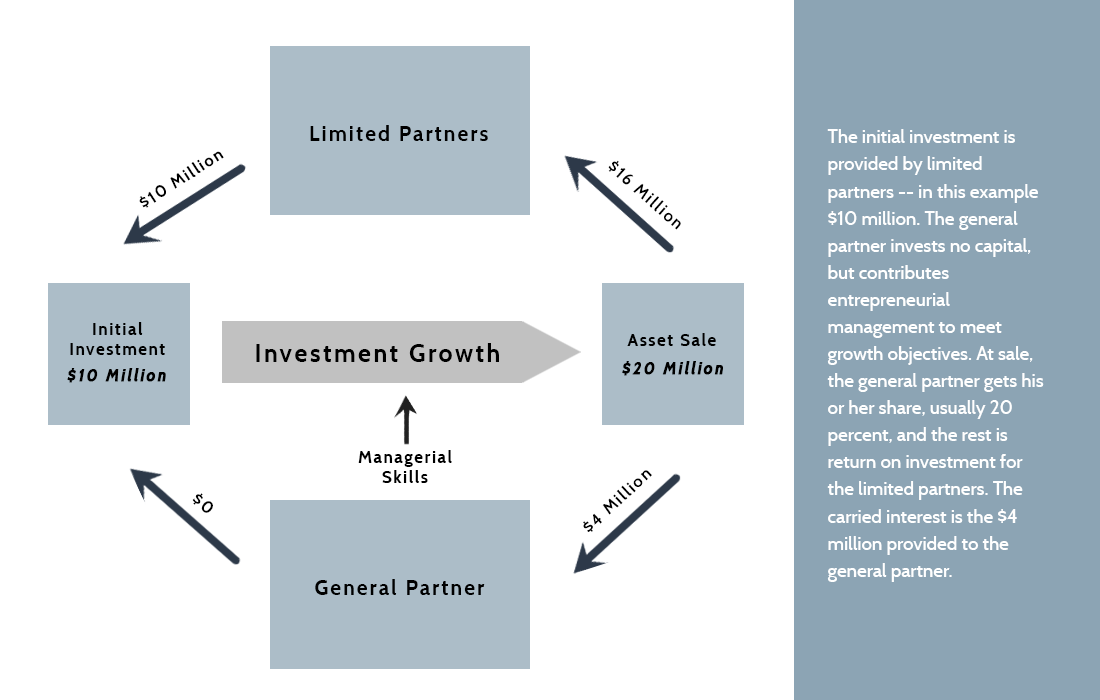

The Tax Treatment Of Carried Interest Aaf

Advisors Say Life Insurance May Help Offset Biden S Proposed Tax Hike

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Patrick Are Capital Gains Taxes Changing Local News Valdostadailytimes Com

Capital Gains Tax Past Present Future Don T Mess With Taxes

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Constitutionality Of Retroactive Tax Legislation Everycrsreport Com

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

President Biden S Stepped Up Basis Tax Proposal Forbes Advisor

History And Retroactive Capital Gains Rate Changes

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber